Before this crazy pandemic , the Cutter family would often make the drive up to the “big city” to shop, explore, and maybe take in a show or even better, a Sox game. I remember how excited our girls would be as we rolled into the Braintree split and the Boston skyline would come into view. I find that one of the most impressive sights to see is the John Hancock Tower, its glass reflecting the city around it. I remember telling the girls, to their surprise, that “The Hancock” was not always considered the revered landmark it is now. In the early 1970s so many windows would pop out and fall to the ground. Back then, it was often referred to as the “Plywood Tower,” due to the practice of replacing the failing windows with pieces of black plywood.

Eventually the architects, engineers, builders, and project managers identified and corrected “The Hancock’s” flaws. Over the years it has taken its place alongside Fenway Park, The “Pru”, the Old North Church, and the Bunker Hill monument one of Boston’s most iconic places.

“The Hancock” can be an important lesson for financial planning. It’s not necessarily about where you start out, but how you end up. As Jen and I begin to work with new folks to build or improve their financial or retirement systems, we encounter people all along the spectrum in both financial health and how they feel about their finances emotionally. Some folks are discouraged and feel their circumstances are poor or uncertain at best. Others have some parts of their plan working well but need to shore up other aspects. We often find that with some folks, we can help with some moderate fine tuning. In nearly all cases, Jen and I can identify the problems, offer corrections in course, and build towards an integrated, comprehensive solution.

You know, I see a real similarity between a sound financial system and a structure such as a building like “The Hancock” or even your home. Your home may look beautiful from the curb, but it’s hard to enjoy if the foundation is crumbling or the roof is leaking. All of its structural elements including the internal systems, like electronical and plumbing, needs to be maintained and continuously improved to get the most enjoyment out of living there.

When designing and deploying a sound financial and retirement system, four core parts must be included: Income Planning, Asset Management, Advanced Tax Planning, and Estate Planning.

I find that folks can be so consumed with accumulating assets during their working careers that they’ve given little to no thought about how those assets are going to create income in retirement. Not too long ago, most could rely on a pension and Social Security to take care of their income in their golden years. But times have changed and for most of us, guaranteed pensions no longer exist. That fact, along with questions about the long-term durability of Social Security now requires folks to pursue other sources of guaranteed income in retirement.

When it comes to asset management, it must not be just about the chase for the best return. This is important here folks so please stay with me here. Now is the time to evaluate your investments. What happened to them in March? What has happened to them since? How is your current investment system structured? Is it an accumulation, buy and hold system? Heck, we’ve seen how that works. You see, when building a retirement asset management system, managing risk is essential. Your portfolio needs to provide you with income in retirement. But if you are facing a market downturn every six or seven years, how do you create an income plan from that?

Hmmm . . . well, you don’t. At best, it’ll be extremely difficult and far too reliant on luck.

An asset management distribution system must incorporate quantitative data to help that system mitigate losses. By managing the downside, the upside may take care of itself which helps to ensure some measurable and predictable result to your income plan. A flawed asset management system usually leaves you without peace of mind when financial storms hit, especially if you’re in or near retirement.

A good advance-tax plan is the next step to a sound financial and retirement system. As we transition to the distribution phase of our assets, tax planning should include systems that help ensure the most tax efficient use of your assets. It’s crucial to use the right mix of taxable and non-taxable assets to maximize the ultimate return you deserve.

The last component of a sound financial system is proper estate planning. Your financial system represents a lifetime of hard work and many sacrifices along the way. If you want to pass a legacy on to your heirs or to a charity, why not do it in a way that minimizes expense and maximizes what you leave? Everyone needs an estate plan . . . everyone. While a will and healthcare directives are a must, advanced estate planning may be needed. Please do not discount a sound estate plan and please remember that estate planning is best done before there is a sense of urgency.

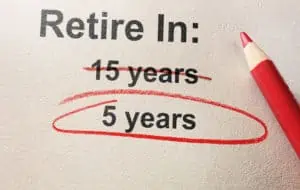

Folks, no one should avoid building a solid financial system because of concerns they are starting too late and are too far behind. The same goes for repairing or updating an existing system that may be flawed or lopsided. A strong financial system will account for all of the correct parts and those parts should be integrated. This not only brings more day to day enjoyment, but if it is properly designed and constructed to withstand the risk of inevitable financial storms and downturns, it can also bring you long term peace of mind. No matter where you are in your retirement journey, take the time to consult with a financial advisor who is a fidcuciary. The sooner you do, the closer you’ll be to the retirement you deserve.

So as always – be vigilant and stay alert, because you deserve more!

Have a great week.

Jeff Cutter, CPA/PFS is President of Cutter Financial Group, LLC, an SEC Registered Investment Advisor with offices in Falmouth, Duxbury, Mansfield & Southlake, TX. Jeff can be reached at jeff@cutterfinancialgroup.com.

This article is intended to provide general information. It is not intended to offer or deliver investment advice in any way. Information regarding investment services is provided solely to gain a better understanding of the subject of the article. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Market data and other cited or linked-to content in this article is based on generally-available information and is believed to be reliable. Cutter Financial does not guarantee the performance of any investment or the accuracy of the information contained in this article. Cutter Financial will provide all prospective clients with a copy of Cutter Financial’s Form ADV 2A and applicable Form ADV 2Bs. Please contact us to request a free copy via .pdf or hardcopy. Insurance instruments offered through CutterInsure, Inc.