Social Security has long been part of the discussion for most of us when it comes to building out a retirement system. Over the past couple of decades, more and more questions have started to arise about the long-term viability of the program. Frankly, I think this COVID virus has just sped up the conversation. I was reminded of this during a call I had last week with an old shipmate of mine, Mark. He is a good guy and he is a great engineer. I sailed with him in the Persian Gulf in the ’90s and have kept close to him and his family since then. After going to sea for almost forty years, Mark is hanging up his wrenches for the warm sands of Florida with his wife of 42 years, Sandy.

After catching up with family stuff, political and social unrest, Covid, and a lack of direction within our public schools, Mark told me that he just turned on his Social Security benefits before his full retirement age.

Hmmm . . . these days there seems to be plenty to talk about.

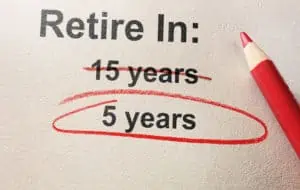

But you know, with all of the concerns we discussed, he was more worried about the future of Social Security itself and wanted to start to get his money out of the system now before drastic changes might be needed. Unfortunately, I find this worry is not all that uncommon among those who plan to retire in the next 10 or 20 years.

For almost all of us, it seems that Social Security has been there forever. But the reality is that it didn’t exist when a lot of our grandparents started their working lives. The Social Security Act became law in 1935, with the primary goal of being a financial safety net for the elderly and the retired in the United States. To say that it was a bipartisan issue might be a bit of a stretch since the President at the time was a Democrat and he was supported by a US Congress that was roughly 75% Democrat. However, it still faced two major Supreme Court challenges in the 24 months after its passage, and if you look at the historical picture of FDR signing it into law you’ll see that he is surrounded solely by members of his own party. Some politicians and people did look at it as being a form of socialism, including one Senator who said, “Isn’t this a teeny-weeny bit of socialism?”

So, what does the near-term and long-term future of Social Security look like? Why are we hearing the rising chorus of concerns about impending drastic changes or possible demise of the program? This week lets you and I dig into what the program looks like today and some of the challenges it’s facing.

For starters, President Trump issued a recent executive order to defer the payroll tax (which funds Social Security and Medicare), and it has some of his opponents speculating that he wants to defund the program. Now, at this point it’s important to remember that the President’s recent order only called for a deferral of the payroll tax with the expectation that those tax dollars would still be collected in the future. Still, anything involving Social Security, and even its peripheral parts can be a political minefield for any politicians brave or foolish enough to enter the battle.

Every year the Social Security board of trustees gives both a short-term (10 year) and long-term outlook (75 year) of the program. For the last 35 years, the board of trustees has provided a long-term outlook that shows there will not be enough future revenue to fund future obligations. As of 2020, the “future” unfunded obligations for the Social Security fund have grown to almost $17 trillion. While the Social Security fund has a reserve of nearly $3 trillion, under current funding patterns that will be completely depleted within about 15 years. Once the reserve is depleted in the mid-2030s, if nothing is done there will be little choice but to reduce benefits by nearly a quarter of their current levels.

Digging deeper, the mechanisms that allow for benefit increases to address inflation don’t necessarily make much sense. The consumer price index (CPI) used to calculate payment increases for retirees and beneficiaries is pegged to the CPI-W. But the CPI-W doesn’t adequately reflect what actual retirees are experiencing in retirement. For example, the CPI-W gives more weight to items less critical to retirees such as education, clothing, and transportation. However, the primary challenge for retirees is the cost of medical bills, prescription drugs, and long-term care costs. In some recent years, there has been no adjustment for inflation, while the costs associated with being elderly continue to rise.

We have also experienced a dramatic shift in the demographics of the U.S. since the Social Security Act came into being over eighty years ago. As a population, we have seen a substantial slow down in our birth rate. We are now at a birth rate of 1.7 (number of children each woman will give birth to in her lifetime), which is below the 2.1 required to just maintain the population. Folks, this is not good. We are nearing a point where nearly half of the population growth in the US is attributable to immigration. The US population is also living considerably longer and as a result, spending many more years in retirement. We have added roughly 15 years to our life expectancy since Social Security was enacted. We have already seen this reflected in changes to Social Security payments and full benefit eligibility ages as far back as 1983.

When all of this is taken into consideration, it certainly seems that the program will have to be changed in how it is funded and the rules and limitations for beneficiary payouts. To answer Mark’s question about will it be there for the long-term? I believe the answer is yes, absolutely. It just won’t look the same. Any retirement system might do well to reconsider some of the long-held assumptions about Social Security and consider any downside risks those assumptions might be leaking into their system. So, what’s your retirement system?

Be vigilant and stay alert, because you deserve more!

Have a great week.

Jeff Cutter, CPA/PFS is President of Cutter Financial Group, LLC, an SEC Registered Investment Advisor with offices in Falmouth, Duxbury, Mansfield & Southlake, TX. Jeff can be reached at jeff@cutterfinancialgroup.com.

This article is intended to provide general information. It is not intended to offer or deliver investment advice in any way. Information regarding investment services is provided solely to gain a better understanding of the subject of the article. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Market data and other cited or linked-to content in this article is based on generally-available information and is believed to be reliable. Cutter Financial does not guarantee the performance of any investment or the accuracy of the information contained in this article. Cutter Financial will provide all prospective clients with a copy of Cutter Financial’s Form ADV 2A and applicable Form ADV 2Bs. Please contact us to request a free copy via .pdf or hardcopy. Insurance instruments offered through CutterInsure, Inc.