Wendy and Mark, a couple in their fifties from Plymouth, came to see Jen and me a few weeks ago. Both are still working, but the runway to retirement is shrinking, and they wanted better control over their financial lives.

Wendy is a media strategist for a large Boston firm, and Mark manages a luxury car dealership. They have two grown kids, young men in their twenties with full-time jobs. One still lives with Mom and Dad along with his fiancée, but they have 2020 wedding plans and are saving for a place of their own.

“One kid is out the door, and the other has his foot out the door,” Mark mused. “I keep telling him that I’m going to change the locks once he’s gone so he can’t come back, but he doesn’t believe me.”

Hmmm . . . Mark’s a funny guy. At least, I think he was joking.

Wendy and Mark seem ready for an active retirement. They’d like to travel more, attend the symphony, tour museums, and visit art exhibits. They also want to spend more time in Florida, where they have a vacation condo.

Wendy and Mark have done well for themselves, putting their retirement savings into a diverse portfolio of investments. But, they were concerned about their expenses in retirement, and once we took a look at their budget, so was I.

You see, Wendy and Mark carried significant debt. They have a mortgage, a large home equity loan on their Plymouth house and another for that Sanibel Island vacation condo. Additionally, there are outstanding student loans for Wendy’s MBA, which she got late in life. They also helped finance their sons’ educations. Finally, they had a significant balance on their high-interest credit cards.

“I know it doesn’t look like it, but I hate debt,” Mark stressed. “Given my druthers, I’d like to retire and live debt-free. I don’t want to owe anyone anything.”

That’s a reasonable aspiration, but for many of us, it’s not realistic. In fact, retiring with debt is hardly unusual. 70% of U.S. households headed by those age 65-74 carry some debt, according to the most recent Survey of Consumer Finances published by the Federal Reserve. The days of retiring completely debt-free may be over for most of us.

Actually, 4 in 10 retirees cite paying off debt as a priority, according to a recent survey by the Transamerica Center for Retirement Studies. The median debt owed by retirees in that study is $52,000 in mortgage debt and $4,000 in non-mortgage debt. So, debt is a genuine problem for a lot of retirees. Designing a good solution to manage it in retirement must be a priority.

I told Wendy and Mark that I don’t look at debt as good or bad. Instead, I think of debt is a tool. There’s constructive debt, such as a home mortgage or a mortgage on a vacation home, and destructive debt, that is money you owe on credit cards or loans on depreciating assets like cars and boats. Generally speaking, as you approach retirement, prioritizing the reduction of destructive debt is a good idea.

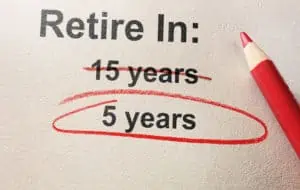

As Wendy and Mark examined their retirement strategy and projected their income post-retirement, they realized their expenses in the first few years of retirement would outstrip their income. This is a crucial time – they can’t afford to spend money that they won’t be able to replace in their retirement. After our discussions, Wendy and Mark realized that they needed to readjust their expenses to suit their retirement plans better.

After performing an income analysis, we designed a debt reduction plan for Wendy and Mark. It helps them systematically reduce their debt as much as possible before retirement.

The kicker, however, was the realization that their mortgage, particularly on the Plymouth house, will absorb much of their monthly income. After several home equity loans for renovations and college expenses, their timeline and the mortgage were posed to derail their retirement plans.

After 2020 their younger son and his fiancée are on their own. I suggested to them that they really won’t need a sprawling four-bedroom, three and a half bath house anymore. The concept of being empty-nesters is new to Wendy and Mark. But, the light was dawning. And they began to realize that one of the advantages of having an empty nest was, well, getting rid of the nest!

At first, thinking about selling the family home was a shock. But, once we began discussing it, the idea became more appealing.

“Don’t think of it as downsizing,” I explained. “Think of it as right-sizing. Your lifestyle has already changed significantly since the boys were kids. It will continue to do so. It’s important to align your income and your expenses with the life you want, as opposed to the life you have.”

Projecting their expenses and cash flow in retirement, Wendy and Mark understood that selling the Plymouth home will lower their expenses to align more consistently with their income in retirement. They – like many retirees – expect their post-retirement income to be about 80% of their pre-retirement income.

Unloading their big Plymouth home didn’t just mean eliminating the mortgage. They’ll also lose other associated expenses including maintenance and upkeep, property taxes and utilities. Frankly, it’s quite a big nut at the end of the day that they’ll be able to reallocate.

The equity from the Plymouth house will help them pay down other debt they’d like to retire before they retire. They’ll have enough left over to use as a down payment for a smaller place better suited to their new lifestyle as empty-nesters.

Looking over their new plan, Mark chuckled, “One advantage to right-sizing: I won’t have to change the locks to keep the boys out!” Wendy was quick to point out that the Florida condo even has a nice guest room.

Through some debt management and a plan to right-size their life when the time comes, Wendy and Mark have taken control of their upcoming retirement.

Just like them, I encourage you to be vigilant and stay alert, because you deserve more.

Have a great week folks!

Jeff Cutter, CPA/PFS is President of Cutter Financial Group, LLC, a wealth management firm with offices in Falmouth, Duxbury, and Mansfield. Jeff can be reached at jeff@cutterfinancialgroup.com.

Cutter Financial Group LLC (“Cutter Financial”) is a SEC Registered Investment Advisor.

This article is intended to provide general information. It is not intended to offer or deliver investment advice in any way. Information regarding investment services is provided solely to gain a better understanding of the subject or the article. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable.

Market data and other cited or linked-to content on in this article is based on generally-available information and is believed to be reliable. Cutter Financial does not guarantee the performance of any investment or the accuracy of the information contained in this article. Cutter Financial will provide all prospective clients with a copy of Cutter Financials Form ADV2A and applicable Form ADV 2Bs. Please contact us to request a free copy via .pdf or hardcopy.