Most of us spend decades dreaming about and preparing for that magical day when we will retire. When we walk out the door from our job for the last time and enter a new phase of our lives. One filled with freedom, fun and adventure. We dream of things like sleeping in, socializing with friends, focusing on a hobby, and perhaps traveling or spending more time with the grandkids. We have sacrificed, saved and invested for that day, and are excited to finally enjoy the fruits of our labor.

But being able to experience all these benefits of retirement requires careful planning – planning that focuses on creating income you can rely on for the rest of your life. Amassing a large sum of money is admirable but in order to spend that money with confidence, you need to have a plan that turns it into income. You see, investing for retirement and taking income in retirement are entirely different things, and planning for each will look much different. Unfortunately, this is something that many pre-retirees fail to realize and properly prepare for.

Building sources of lifetime retirement income can be complicated. As a result, either you might spend too much, which increases your chance of running out money, or you might be overly cautious and spend less than you could have and miss out on fully enjoying your retirement.

Take Gordon and Jen, a nice couple from Oak Bluffs I met with recently. They want to retire in about 3 years and wanted a second opinion on their retirement plan. They were looking forward to the prospect of being able to see Europe, to visit their granddaughters frequently in Montana, and to shore up their golf games.

As we reviewed their investments, it was clear that they had been diligent savers and investors. Between their respective 401k plans and their brokerage account, they had over $1.6 million in savings. Gordon explained that they were pretty confident that these funds would see them through retirement, and hopefully would have some funds left for their kids and grandkids when they passed.

Hmmm . . . not so fast.

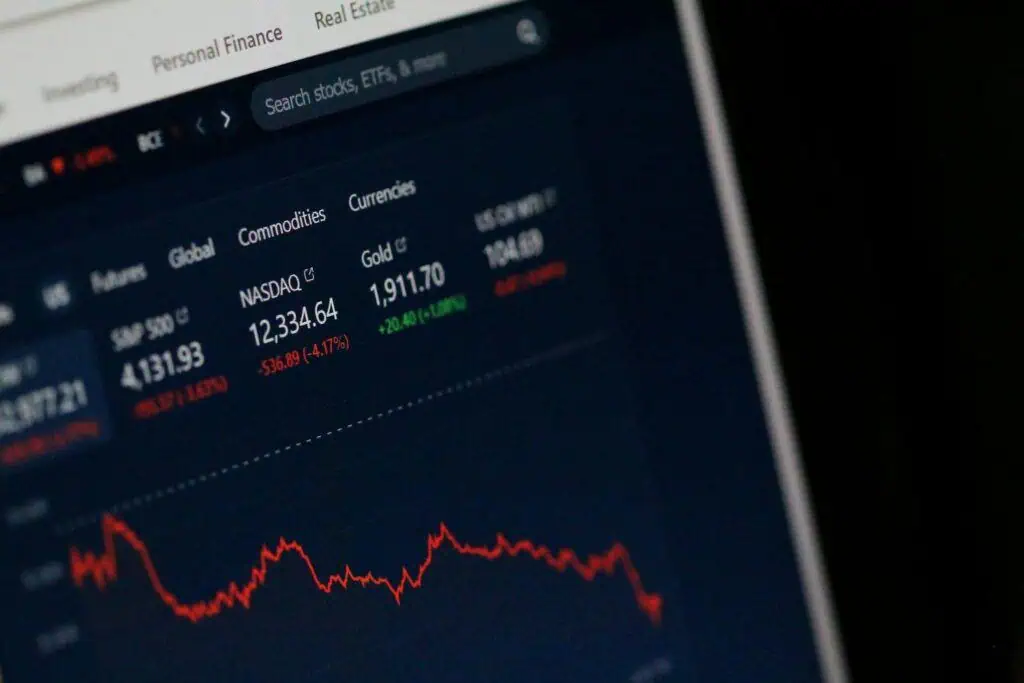

Now, I hated to stir things up, but it was time for a reality check. You see, taking income in retirement is much more complicated than that. So, after an analysis on their current strategy, looking at the behavior of their investments, they are clearly in an accumulation strategy designed to just “let it ride”. You see, staying with an accumulation plan with no Downside Risk Mitigation (DRM) built into their strategy, Gordon’s confidence level began to crumble. I showed him that if we incorporate DSM using quantitative data that may allow to reduce losses in a terrible market, well, it has less of an impact on his income plan, possibly, giving them a much more peace of mind. In retirement the investment system must work with the income system to hopefully provide and measurable and predictable flow of money. A simplistic approach, such as their current system, could have some major repercussions down the line.

Another concern I expressed to Gordon and Jen is their lack of a prepared retirement spending plan as they transition into retirement and instead of them “winging it,” hoping everything will be OK. Folks, hope is not a plan.

For starters, I explained that they need to break their expenses out into fixed and variable. Fixed would be things like a mortgage, insurance, etc. Variable would be eating out, vacations, etc. We need to make sure their income is greater than their expenses. The income for fixed expenses should not come from sources that fluctuate with the markets. If the markets take a downturn, you still need the same amount of money to pay the bills. It’s not like you can call your mortgage company or insurance carrier and tell them you need to make a reduced payment because your income has decreased. Instead, you should consider income from sources such as Social Security, pensions, fixed annuities or bonds.

Another big mistake I often see is not accounting for taxes in retirement. I explained that their large sum they have invested in an IRA or 401k plan, well, It’s not all theirs. Uncle Sam has allowed you a potential benefit from tax deferral on these funds for years and now he wants his share and will require that you start taking income and paying taxes on these funds (aka, Required Minimum Distributions) starting at 73. I explained to them that this means a significant reduction in income left over for them and that needs to be factored into their spending plan.

Another common mistake I see is not leaving enough flexibility in a spending plan. It’s inevitable that you’ll experience spending surprises or that your spending might increase due to inflation, home repairs, health care costs and more. It’s important to build an emergency fund to address spending surprises.

Married couples also need to have a plan for the day when one spouse passes away, and this is often overlooked. Usually, the survivor’s retirement income drops significantly, but their spending doesn’t drop very much. The lower of the 2 Social Security checks will go away, yet most other essential expenses remain the same. On top of that, the surviving spouse now must file taxes as single, the highest personal income tax bracket there is.

Folks, as you can see, there’s a lot to consider when building a retirement income system and avoiding common mistakes. Fortunately, we were able to help Gordon and Jen build sound investment and income systems to help put them in the highest probability of financial success. Have you checked your system? Have you built a comprehensive retirement system that includes a downside risk mitigation program? If so, great. If not, why not?

So as always – be vigilant and stay alert, because you deserve more!

Have a great week.

Jeff Cutter, CPA/PFS is President of Cutter Financial Group, LLC, an SEC Registered Investment Advisor with offices in Falmouth, Duxbury, and Mansfield, MA.

Insurance offered through its affiliate, CutterInsure, Inc. We do not offer tax or legal advice. Jeff can be reached at jeff@cutterfinancialgroup.com. This information is intended to provide general information. It is not intended to offer or deliver investment advice in any way. Information regarding investment services is provided solely to gain a better understanding of the subject of the article. Different types of investments involve varying degrees of risk, including the potential for loss. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Insurance product guarantees are backed by the financial strength and claims-paying ability of the issuing company. Market data and other cited or linked-to content is based on generally available information and is believed to be reliable. Cutter Financial does not guarantee the performance of any investment or the accuracy of the information contained in this article. Cutter Financial will provide all prospective clients with a copy of Cutter Financial’s Form ADV 2A, Appendix 1, applicable Form ADV 2Bs and Form CRS as well as the firm privacy policy. Please contact us to request a free copy via .pdf or hardcopy. 1. https://tinyurl.com/2k8p3je4