This pandemic is causing challenges on all fronts with all the Cutter’s cooped up. The other day I went looking for my favorite snack that my daughter, Sophie, and I favor . . . Cheezits. Well, she beat me to the punch. A quick scan of the pantry shelves reminded me of the toilet paper aisle at Shaws . . . empty. With all five of us being home during the pandemic, we are really putting a major dent in the food supply at the house.

Please don’t read too much into this, but in the division of household chores my wife, Jill, generally does the bulk of the grocery shopping. I’m good for the loaf of bread or a gallon of milk on the way home from work, but full disclosure requires that I admit I am not what you would characterize as a strong grocery shopper. I thought about grousing about the scant cupboards to Jill but saw that she was busy working in her office upstairs.

Time for me to step up and help out.

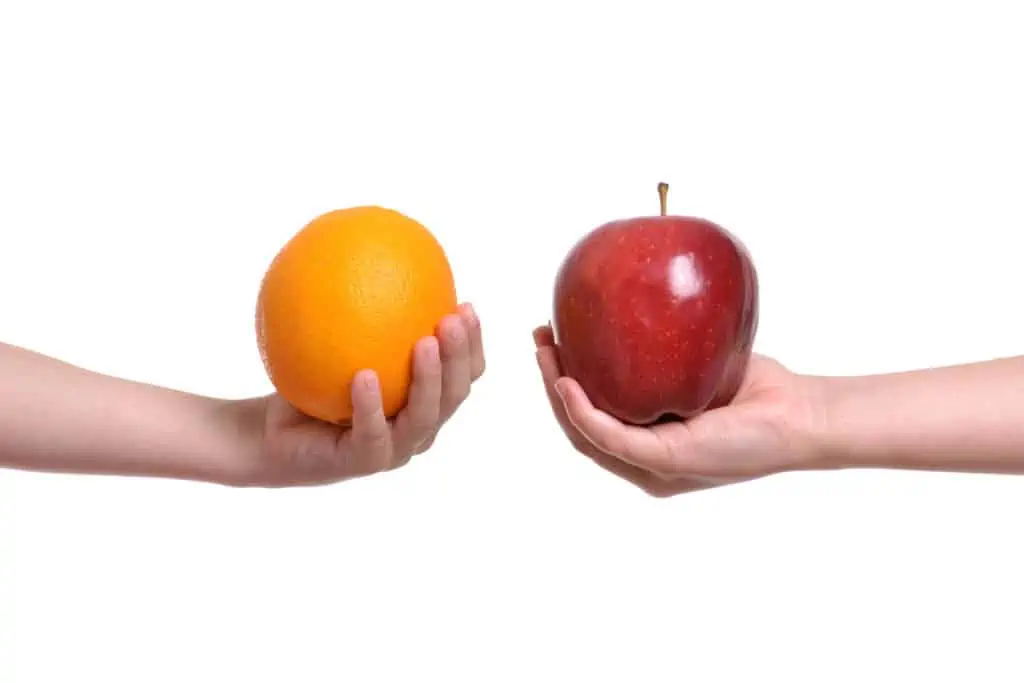

So, I made a quick mental list, grabbed my face mask, wallet, and car keys and off I went. Going by memory of the various paper towels, vegetables, fruits, and chicken I was accustomed to seeing at home, I loaded up my shopping cart. And I made sure to get extra Cheezits, store brand of course. I proudly restocked the pantry shelves at home. Well, no good deed goes unpunished. I spent the rest of the day fielding complaints because well over 90% of what I had bought were knock off brands, many of inferior quality I was told. But how had this happened? Maeve quickly answered my question. She set five of the items I had bought next to some of the comparable items we still had on hand. The resemblance in the packaging was astonishing. The same colors, labelling fonts, and barely perceptible changes in the product names. I quickly concluded that I hadn’t really bought what I intended to buy.

You know, this got me thinking. I got thinking about how I see some of the same things happening in my own industry of financial services. For example, for years there has been a clear distinction between the services and credentials of Registered Investment Advisors (RIAs) and Investment Brokers. Generally speaking, that distinction centers on the fact that Registered Investment Advisors act as fiduciaries, always putting the client’s interest first and rigorously avoiding conflicts of interest. This fiduciary standard was created by the Registered Investment Act of 1940, much of it in response to unregulated practices that brought on the 1930’s depression. On the other hand, those who are securities representatives working for brokerage firms and banks have historically been subject to a suitability standard, which requires only that the recommendation made to a consumer be suitable for their needs.

Folks, I wrote about this very topic a few weeks back, and in particular about the hypocrisy of the Certified Financial Planning Board’s definition of a fiduciary. Recent industry articles have cropped up that support my recent blog on the topic, and I believe that it’s so important for you to understand who is looking out for your best interests – or not.

The Board of Certified Financial Planners (CFP Board) and the Securities and Exchange Commission (SEC) have both adopted a new rule effective June 30, 2020 that will further dilute the distinction between RIAs and for CFPs working for brokerage houses and banks, by permitting CFPs to claim fiduciary status while still allowing some conflicts of interest. The Institute for the Fiduciary Standard states just as much in a recent white paper. “Regulators treated brokerage sales and fiduciary advice differently for years, stressing the harms and risks of conflicts of interest. Avoiding conflicts, if at all possible, was the norm. That was yesterday,” Institute President and author Knut A. Rostad told Financial Advisor magazine.

Hmmm . . . but what about today.

Within the CFP Board’s rebuttal to these claims seems to be a contradiction in itself. According to the CFP Board, its new conduct code “provides clear and unambiguous benefits for consumers.” However, the CFP Board went on to state, “With the new code and standards, CFP professionals make a commitment to CFP Board to provide fiduciary-level financial advice to clients, regardless of how they are compensated. CFP Board has always been compensation neutral and, thus, business model-neutral,” the organization added. So, on the one hand the CFP Board is claiming unambiguous or a clear-cut benefit for consumers, while also claiming neutrality regarding advisor compensation and business models. That’s a bit like saying you can be impartial refereeing a game you’ve bet money on. And you know – that is crazy.

Folks, Registered Investment Advisors have always been required to put forth any conflicts they have in a limited, simple and transparent way to consumers. On the other hand, Broker-Dealers conflicts are often shrouded in so much complexity that some of them admit that even their own representatives can’t understand them.

The Institute for the Fiduciary Standard recommends that the SEC and CFP board change the standard. They believe that we need to require broker-dealers to mitigate or manage all material conflicts. “Disclosures and general principles alone are not enough. Concrete guidance is called for,” the paper stated. They recommend that we rate advisor and representative conflicts on the basis of their magnitude, complexity and opaqueness, including their potential harms and risks to customers. Improve the testing of customer comprehension of conflict disclosures. “Greater transparency in fees and expenses has already helped increase ‘customer comprehension’ of the cost of investment advice and financial planning. Firms should commit to testing or affirming customer comprehension of materially conflicted recommendations,” the paper said.

Until the CFP Board and SEC correct the course they are on, it will be akin to allowing CFPs to package themselves as being the “same” as RIAs and that simply isn’t the case. So for now, it’s up to you to ask probing questions to make sure you are working with a true fiduciary. And because the packaging can be deceiving, you need to look more carefully to make sure you’re getting what you’re looking for!

So as always – be vigilant and stay alert, because you deserve more!

Have a great week.

Jeff Cutter, CPA/PFS is President of Cutter Financial Group, LLC, an SEC Registered Investment Advisor with offices in Falmouth, Duxbury, Mansfield & Southlake, TX. Jeff can be reached at jeff@cutterfinancialgroup.com.

This article is intended to provide general information. It is not intended to offer or deliver investment advice in any way. Information regarding investment services is provided solely to gain a better understanding of the subject of the article. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Market data and other cited or linked-to content in this article is based on generally-available information and is believed to be reliable. Cutter Financial does not guarantee the performance of any investment or the accuracy of the information contained in this article. Cutter Financial will provide all prospective clients with a copy of Cutter Financial’s Form ADV 2A and applicable Form ADV 2Bs. Please contact us to request a free copy via .pdf or hardcopy. Insurance instruments offered through CutterInsure, Inc.